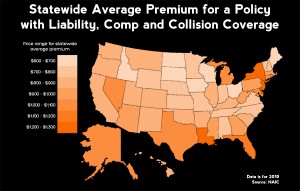

In December, the National Association of Insurance Commissioners (NAIC) released its annual “Auto Insurance Database” report that, among other things, includes average auto insurance expenditures for all 50 states and Washington, D.C.

In December, the National Association of Insurance Commissioners (NAIC) released its annual “Auto Insurance Database” report that, among other things, includes average auto insurance expenditures for all 50 states and Washington, D.C.

According to the report, New Jerseyans spent the most on coverage between 2009 and 2010, forking out an average $1,157 on a policy. At the other end of the spectrum, South Dakotans had the lowest average expenditure, coming in at $525.

Many media outlets use the NAIC’s figures to put into perspective how expensive a particular state’s average policy costs are in relation to other states. But comparing how much car insurance costs between states is actually rather complicated, and it may not be prudent to put too much stock in the rankings. The reason is that, when you compare rates between states, it’s nearly impossible to do one of the things all auto insurance buying guides tell you to do: make sure to compare rates for the same coverage.

When you go to make cost comparisons between insurers, you’re supposed to always get quotes for identical coverages, coverage limits, deductibles, and optional add-ons. If you don’t do that, you’re comparing prices for different products, which doesn’t make sense to do. You always want to make an apples-to-apples comparison. But an apples-to-apples comparison between states can be problematic.

For Example: Ohio vs. Michigan

To illustrate this point, we’ll use Ohio and Michigan as an example. In Ohio (and most other states in the country), drivers are only required to carry liability insurance, which pays other drivers and pedestrians for their hospital bills and repairs that are the result of an accident caused by the policyholder who caused the crash. Straightforward enough, right?

But in Michigan, the situation is much, much different. There, all drivers are required to carry personal injury protection coverage (PIP), personal protection insurance (PPI), and residual liability coverage.

PIP insurance is totally different from the liability insurance required of drivers in most states. With liability, the insurance pays, up to the policy limits, for other people’s damages who were in an accident caused by the policyholder. With PIP, the insurance pays for the policyholder’s own injuries after a crash. And in Michigan, PIP pays for treatment of those injuries on a limitless basis. That means if you were injured in a crash, you have unlimited coverage for treatment of your injuries for the rest of your life.

And while Ohio liability insurance will also cover other people’s car and property damages that were caused by the policyholder (up to the policy limits), Michigan’s PPI only covers other people’s property damages if those damages weren’t to a car. So PPI would cover a fence that you barreled through, but not a bent fender that got that way because of your driving.

Finally, Michigan’s residual liability insurance operates in basically the same was as Ohio’s liability insurance, except it usually only kicks in if the crash resulted in death, serious injury, or permanent disfigurement.

Because of the extensiveness of Michigan’s standard coverage, the state is regularly regarded as one of the most expensive states for coverage, but if you look at the NAIC rankings, it comes in as the 10th-most expensive. Why? Probably having to do with it is the fact that the one-of-a-kind coverages we just mentioned — PIP and PPI — aren’t included in the rankings. The rankings only include a state’s spending habits for liability, comprehensive, and collision coverage.

(Read more about how the NAIC’s average auto insurance costs are calculated here.)

So if you were moving from Ohio to Michigan and wanted to see how much the exact same policy you have now would cost after the move, you wouldn’t be able to. Sure, your current policy satisfies the minimum coverage requirements in Ohio, but in Michigan it just won’t cut it, and you’ll likely have to pay a lot more.

The same goes for a number of other states. There are 12 states that require drivers to carry PIP (also known as no-fault insurance), while the remainder only require liability coverage. When you lump all of them together for one comparison, what you end up with is apples and oranges.

If all states required the same types of coverages, it would be easy to make comparisons between them. But since the requirements vary widely, doing so is problematic.