Liability coverage is mandatory; however, state laws give drivers the option of rejecting or buying Personal Injury Protection (PIP) when it comes to Kentucky auto insurance. The recommended action is to become familiar with both options in order to fully understand and make an educated and informed decision.

Liability coverage is mandatory; however, state laws give drivers the option of rejecting or buying Personal Injury Protection (PIP) when it comes to Kentucky auto insurance. The recommended action is to become familiar with both options in order to fully understand and make an educated and informed decision.

Should I Buy or Reject KY Personal Injury Coverage?

Although higher limits can be purchased, PIP usually provides policyholders with up to $10,000 of coverage for medical expenses, loss of wages and replacement services in the event of a car accident regardless of fault. Choose to buy auto insurance based on your personal preference and needs. The following pros and cons of buying or rejecting this coverage may help you make a more informed choice:

A good choice is to get enough coverage to be satisfied in the event of the unexpected. It’s always good to get car insurance quotes on all types of coverage in order to see the price differences. Additionally, one may be surprised at the small increase of premium added by certain valuable coverage.

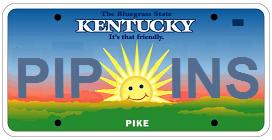

Whatever choice is made, be sure to stay insured at all times because it can be more expensive to be caught uninsured. Aside from the financial setback one can get into, failure to carry insurance is a criminal offense punishable by fines and loss of vehicle or driver license. Proof of insurance must presented to the County Clerk for vehicle registration and must be carried in the vehicle at all times for presentation to authorities or reference in the event of a collision.

This article brought to you by Online Auto Insurance