Before you sign your loan papers and take your new car home, it's important to understand the dangers of a balloon payment car loan.

What is a Balloon Car Loan?

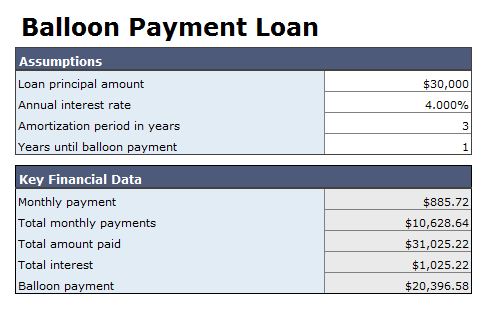

Balloon auto loans are structured to reduce monthly payments by shifting a significant portion of your loan to one final payment. So you might cut each payment by $100 and add a final installment of $5,000 at the end of the loan's term. Since lenders front-load interest, when your balloon payment comes due you are usually paying off the principal of the loan.

So what are the dangers?

See what kind of interest rates you can get >>

Keep Your Payments Low

A balloon loan is a good option if you need to keep your monthly payments low and know you'll have the money to pay it off towards the end of the term. Additionally, balloon loans are an option for those people who absolutely need a new car but have no money for a down payment.

Plan in Advance

It's important to plan for your balloon payment in advance. Save monthly, or invest with this in mind. You should also know that refinancing a balloon loan can be difficult. It may be possible to extend the length of your balloon loan at the end of the term, but that isn't guaranteed. And if you do refinance, you might end up stretching your original three-to-five year term to seven years, or even longer.

Not having the money for your balloon payment at the end of the loan is really the worst-case scenario for the lender -- and for you. If you miss your payment, cannot make arrangements, or cannot refinance, you may lose the car even after you've paid the interest for all those years.

If you have the option to buy the car back, you still have to come up with the principal to do so. Under a normal loan, if you lost your car towards the end of the term you could buy it back for far less than you could with a balloon loan.

There are many concerns you should have about taking out a balloon payment car loan:

See what kind of interest rates you can get >>

Here are some of the benefits of getting a Balloon Car Loan:

See what kind of interest rates you can get >>

There are two main requirements for getting a balloon car loan:

Getting a Balloon Payment Car Loan with Bad Credit >>

It is important to take the time to compare a balloon car loan against different loans. You do this to make sure you are getting the best deal possible. Taking the time to compare these types of car loans is very important, but knowing how to compare the balloon payment car loans is also important.

1. Understand the End Number

Every balloon payment car loan has a final number -- this is the amount you will be making on your final payment. You should understand what that number is going to be, so ask.

2. Check out the Monthly Payment

Knowing you can afford the payment is also something you should know. During the course of the loan, the amount you pay each month could rise, making later payments much larger than when they started. Check this out by calculating the interest rate, and the total cost of what you are paying off.

Finding Balloon Loans with the Best Rates >>

3. Compare the Interest Rates

Knowing which interest rates you are going to be paying is crucial to your bottom line cost. Compare rates and compare the rates of how the loans will increase, or decrease over time. Check each lender and ask for a detailed amortization (or amount of projected time it would take to pay off the debt) of the loan. This will show you exactly where you will stand each month.

Balloon loans can be extremely beneficial to the right customer, but you should be aware of the dangers. More so than any other loan, you need to have a plan to take care of the balloon payment ahead of time. With careful planning and proper research you may be able to avoid any drawbacks.

Image source: juliancolton